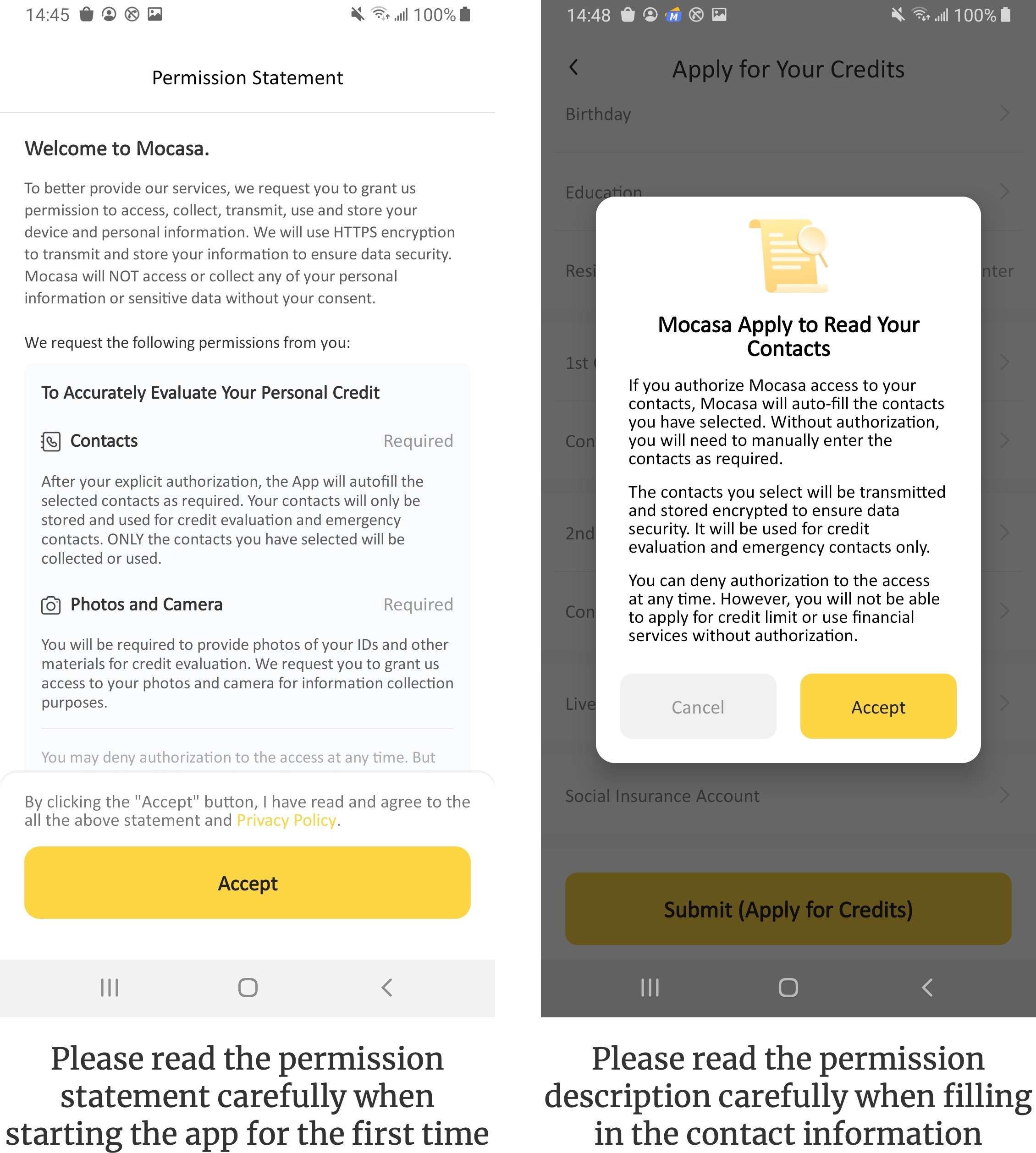

Statement of Applying for Contacts Permission

To accurately evaluate your personal credit, we request you to grant us permission to access, collect, transmit, use and store your contacts information. We will use HTTPS encryption to transmit and store your information to ensure data security.

After your explicit authorization, the Mocasa App will autofill the selected contacts as required. Your contacts will only be stored and used for credit evaluation and emergency contacts. ONLY the contacts you have selected will be collected or used.

Mocasa will NOT access or collect any of your personal information or sensitive data without your consent. Your contacts will NOT be shared or sent to third parties under any circumstances.

You may deny authorization to the access at any time. But you will not be able to use Mocasa financial services, such as applying for credit limit or making payments without authorization.

Mocasa will attempt to obtain the contacts information and upload them to Mocasa server only after your have granted authorization. If you wish to revoke historical authorizations and erase all your device or personal information, please contact support.user@mocasa.com. We will process our application within 5 working days.

PRIVACY POLICY

Philippine Cashtrout Lending Corp. doing business under the name and style of (“Mocasa”) is committed to protecting your personal information and your right to privacy in compliance with Republic Act No. 10173 or the Data Privacy Act of 2012 (“DPA of 2012”), its Implementing Rules and Regulations (“DPA IRR”), the issuances of the National Privacy Commission (“NPC”) in relation thereto, and with the adoption of constantly changing commercially acceptable standards for data protection.

This Privacy Policy sets out the commitment of Mocasa regarding the collection, processing, and storage of personal information and sensitive personal information (collectively “Personal Data”) in accordance with the DPA of 2012, the DPA IRR, and other issuances by the NPC. We hope you take some time to read through it carefully, as it is important. If there are any terms in this Policy that you do not agree with, please discontinue use of our Services immediately.

This Privacy Policy applies to all information collected through our Services (which, as described above, includes our App), as well as any related services, sales, marketing, or events. Please read this Policy carefully as it will help you understand what we do with the information that we collect.

We are a Company duly organized and existing under the laws of the Republic of the Philippines (Company Registration No.CS201910407) and are licensed by the Securities and Exchange Commission to operate as a Financing Company (Certificate of Authority No. 3015).

Pursuant to this, you may register in the Mocasa Mobile Application or Website (“Mocasa Platform”) and, subject to our Terms and Conditions, be eligible to apply and receive loan/s under our Services. To do this, we will need to collect your personal information to the extent needed for you to access and for us to provide to you our Services.

SECURITY

Much of the information we hold about you will be stored electronically in secure data centers and others will be stored in paper files. We recognize how important it is to protect and manage the information you share with us. We use a range of physical and electronic security measures to protect the personal information we hold. In addition, we use computer safeguards such as firewalls, data encryption, and physical access controls to our office and files. We only authorize access to employees who require it to fulfill their job responsibilities.

Our security systems meet or exceed industry standards and we are constantly monitoring the latest developments to ensure our systems evolve as required.

PERSONAL INFORMATION WE COLLECT

We collect information about you in the following ways:

Information automatically collected through the Mocasa Platform

When you visit the Mocasa Website, we automatically collect certain information about your device, including information about your web browser, IP address, time zone, and some of the cookies that are installed on your device. Additionally, as you browse the Mocasa Website, we collect information about the individual web pages or products that you view, what websites or search terms referred you to the Site, and information about how you interact with the Site. We refer to this automatically collected information as “Device Information.”

We collect Device Information using the following technologies:

“Cookies” are data files that are placed on your device or computer and often include an anonymous unique identifier. For more information about cookies, and how to disable cookies, visit http://www.allaboutcookies.org. “Log files” track actions occurring on the Site, and collect data including your IP address, browser type, Internet service provider, referring/exit pages, and date/time stamps. “Web beacons,” “tags,” and “pixels” are electronic files used to record information about how you browse the Mocasa Website.

In addition, when you collect money or attempt to withdraw cash through the Mocasa platform, we will collect certain information from you, including your name, billing address, shipping address, email address, and phone number.

Information you voluntarily provide through communications with us

We collect personal information that you voluntarily provide to us when you register on the Mocasa Platforms, express an interest in obtaining information about us or our products and Services, when you participate in activities on the App or otherwise when you contact us.

The personal information that we collect depends on the context of your interactions with us and the App, the choices you make and the products and features you use. The personal information we collect may include the following:

Personal Information provided by you. We collect your full name; citizenship; date of birth; place of birth; present and permanent address; phone numbers; email addresses; contact preferences; self-reported income; employer, employment status; mobile plan status; government I.D., photo (selfie), proof of income and other similar information.

All personal information that you provide to us must be true, complete, and accurate, and you must notify us of any changes to such personal information.

Information you have authorized us to collect from third-party providers and outside sources

When you sign up to Mocasa, you consent to the use by Mocasa of any information that you have provided. When signing up, you authorize Mocasa directly or through its Partners to collect, retrieve, process, and store the data for the purposes including but not limited to credit investigation, risk evaluation, data analytics, collections process, data profiling, marketing, etc.

When you sign up to Mocasa you authorize us to collect information from various services and networks including telecommunication companies (e.g., Globe Telecom, Inc., Smart Communications, Inc., PLDT, Inc., Sun Cellular/Digitel Mobile Philippines, Inc.), utility companies (e.g., Meralco/Manila Electric Company, Maynilad Water Services, Inc., Manila Water Company, Inc.) government agencies (such as SSS, GSIS, NSO, BIR), credit bureaus (e.g., CIC, CIBI), remittance and transfer companies (e.g., as Palawan Express, Cebuana Lhuillier), financial service providers (e.g., DragonPay Corporation, Xendit Philippines Inc., PayMongo, Gcash,PayMaya Philippines, Inc.), financial institutions, financing companies, banks, your employer and other service providers, online or otherwise.

USE OF YOUR PERSONAL INFORMATION

We will hold and use the following details about you:

Your name, address, phone numbers, email address, date of birth, employment and banking and financial details and other details shared during the application process.

Demographic information.

Information we receive when making a decision about you, your loan or application (including information collected from credit bureaus or other sources).

Details of the loans you have and have had with us and all transactions.

Details of when you contact us and when we contact you; and

Any other information which we need to operate your account, make decisions about you, or fulfill the regulatory obligations.

References to personal information include all of the information above whether obtained from you, from a credit bureau, from the internet or from any other source.

We use personal information collected via the Mocasa Platform for a variety of business purposes described below. We process your personal information for these purposes in reliance on our legitimate business interests, in order to enter into or perform a contract with you, with your consent, and/or for compliance with our legal obligations. We indicate the specific processing grounds we rely on next to each purpose listed below.

We use the information we collect or receive: To facilitate account creation and log-on process;

To perform our Know-Your-Customer (KYC) and Verification procedures;

To perform credit risk evaluation process;

To perform loan origination, fulfillment, and collection;

To comply with our legal obligations;

To perform loan collections;

To administer our business;

To manage user accounts;

To send administrative information (e.g., product, service and new feature information, changes in terms and conditions and policies) to you;

To protect our Services (i.e. to keep the Mocasa Platform safe and secure (for example, for fraud monitoring and prevention));

To enforce our terms, conditions and policies for business purposes, to comply with legal and regulatory requirements or in connection with our contract; and

To fulfill and manage your orders. We may use your information to fulfill and manage your orders, payments, returns, and exchanges made through the App.

We will only process your information in the aforementioned methods if the same is necessary for our performance of our obligations to you and based on your consent.

We commit to implement suitable measures to safeguard your rights and freedoms and legitimate interests. If you wish to exercise your rights regarding profiling, automated processing, and/or automated decision-making you may contact us at helpdesk@Mocasa.ph.

SHARING OF YOUR INFORMATION

The Company acknowledges its role and responsibilities as a Personal Information Controller (“PIC”) under the Law, subject to the provisions of this Privacy Policy. Your personal information will be kept confidential and only shared with others for the purposes listed and explained in this Privacy Policy. We select our partners thoroughly based on their reputation and quality of the provided services. We have long standing and trusting relationships with all Third Party Entities we work with. The use and security of your personal information is regulated by contractual obligations with all Third Party Entities we work with.

The information about you might be shared with entities such as, but not limited to, the following:

any firm, organization, or person we use to help us operate our lending business for the purpose of conducting KYC, determination of credit worthiness, fraud prevention, and to collect payments and recover debts or to provide a service on our behalf;

any firm, organization, or person who provides us with products or services or who we provide products and services to for the purpose of providing such products and performing such services;

any person who has told us and who we reasonably believe to be your parent, carer or helper, when proof is presented that you are unable to handle your own affairs because of mental incapacity or other similar issues for the purpose of proper handling of said affairs;

any payment system we may use for the purpose of disbursement of loan proceeds and payment of loans;

telecommunication companies (e.g., such as Globe Telecom, Inc., Smart Communications, Inc., PLDT, Inc., Sun Cellular/Digitel Mobile Philippines, Inc.), utility companies (e.g., Meralco/Manila Electric Company, Maynilad Water Services, Inc., Manila Water Company, Inc.) government agencies (e.g., SSS, GSIS, NSO, BIR), credit bureaus (e.g., the CIC, CIBI), remittances (e.g., Palawan Express, Cebuana Lhuillier), financial service providers (e.g., DragonPay Corporation, Xendit Philippines Inc., PayMongo, Gcash,PayMaya Philippines, Inc.), financial institutions, financing companies, banks, your employer and other service providers, online or otherwise, for the purpose of:

determination of creditworthiness, conducting all the necessary background checks that may include credit scoring and investigation, and data analytics;

data analytics, statistical analysis and demographics, business development purposes (such as improvement of the websites, mobile applications, and the Lender’s credit scoring algorithm/s, the creation of effective service delivery and payment collection strategies, improving customer experience and customer assistance), and the direct marketing of the Lender’s existing and prospective financial services as well as the products and services of its Partners;

for fraud detection, investigation, and prevention;

for all phases of provisioning the products and services that the Borrower may apply for including evaluation of loan applications, its automated processing, complying with KYC regulations required by the Securities and Exchange Commission, Bangko Sentral ng Pilipinas, and the Anti-Money Laundering Council, credit verification, credit scoring, and payment collection.

certain authorities in order to detect and prevent terrorism (including to authorities outside the Philippines);

any person to whom we sell or transfer (or enter into negotiations to sell or transfer) our business or any of our rights or obligations under any agreement we may have with you. If the transfer or sale goes ahead, the transferee or purchaser may use your personal information in the same way as us;

regulatory agencies and government authorities (including but not limited to, the Bangko Sentral ng Pilipinas, the Bureau of Internal Revenue, the National Bureau of Investigation, the Office of the Ombudsman), including those overseas, where we are requested by them to do so; and

credit bureaus or any similar organization which provides a centralized application matching service that collects information from and about mortgage and/or credit applications, for the purpose of preventing and detecting fraud. We may also provide information to third parties to help them to make decisions about whether to lend to you, allow you extended payment terms or otherwise do business with you.

The Information about you might be shared in order to:

Search credit bureaus’ records (including information from overseas);

Make, or assist in making, credit decisions about you, assess lending (and insurance risks and to check the details that you have let us and others have;

Operate and manage your account and manage any application, agreement or correspondence you may have with us;

Carry out, monitor and analyze our business;

Contact you by email, SMS, letter, telephone or in any other way about our products and services, unless you tell us that you prefer not to receive marketing;

Identify, prevent, detect or tackle fraud, money laundering, terrorism and other crimes;

Form a view of you as an individual and to identify, develop or improve products, that may be of interest to you;

Carry out market research, business and statistical analysis;

Provide information to independent external bodies such as governmental departments and agencies, universities and similar to carry out research;

Carry out audits;

Perform other administrative and operational purposes including the testing of systems;

Trace your whereabouts;

Recover any debt you owe us;

And comply with our regulatory obligations.

Your data may also be used for other purposes for which you give your permission or where we are permitted to do so by law or it is in the public interest to disclose the information or is otherwise permitted under Philippine Law.

CREDIT BUREAUS

When you apply to us for a loan, we will check the following records about you:

Information and records you voluntarily supplied to us or authorized us to collect; and

Information collected from credit bureaus.

Whether or not your application is successful, when credit bureaus receive a search from us, they will place a search footprint on your credit file that may be seen by other lenders. Large numbers of applications within a short time period may affect your ability to obtain credit. This is applicable whether you have been accepted or declined.

The credit bureaus supply us with both public information and shared credit and fraud prevention information including information about previous applications and the conduct of your accounts.

We may also make periodic searches at credit bureaus to manage our relationship with you.

Information provided by you on our applications will be sent to credit bureaus and will be recorded by them. We and other organizations may access and use this information to prevent fraud and money laundering and credit bureaus may use your information for statistical analysis. Information held by credit bureaus will be disclosed to us and to other organizations in order to (for example):

Prevent fraud and money laundering and to check and assess applications for credit, credit related or other facilities;

Recover debts that you owe and trace your whereabouts;

Manage credit accounts and other facilities and decide appropriate credit limits;

Verify your identity;

Make decisions on credit and other facilities for you, your financial associate(s), members of your household or your business;

Check details on proposals and claims for all types of insurance; and

Check details of job applicants and employees.

When you borrow from us, we will give details of your loan and how you manage it to the credit bureaus. If you borrow and do not repay in full and on time, the credit bureaus will record the outstanding debt and, in some cases, the length of time that the debt remains outstanding; other organizations may see these updates and this may affect your ability to obtain credit in the future.

If you fall behind with your payments and a full payment or satisfactory proposal is not received, then a default notice may be recorded with the credit bureaus. Any records shared with credit bureaus will remain on file for a retention period after your account is closed, whether any outstanding sums have been settled by you or as following a default.

If you give us false or inaccurate information and we have reasonable grounds to suspect fraud or we identify fraud, we may record this and may also pass this information to organizations involved in crime and fraud prevention including law enforcement agencies who may then access this information.

We and other organizations may access and use the information recorded by fraud prevention agencies from other countries.

RETENTION OF YOUR INFORMATION

We will hold your personal data and records for as long as necessary for the fulfillment of the above-stated purposes and uses or for the establishment, exercise or defense of legal claims, or for legitimate business purposes, or as may be provided by law (such as tax, accounting or other legal requirements).

In the event that your personal data are no longer required to be retained or we have no ongoing legitimate business need to process your personal information, such data will be disposed or discarded in a secure manner that would prevent further processing, unauthorized access, or disclosure to any other party or the public, or that would prejudice your interests.

Should you wish to have your personal information deleted and destroyed or you wish to withdraw your consent in the processing of your personal information, you may do so by contacting us.

The deletion of your personal data shall be honored within reasonable time from request and as long as it will not compromise, damage, injure, or make inefficient the entirety, integrity, confidentiality, and security of the Mocasa Platform and/or Services, and shall be performed within such reasonable time from the time of your request to do so

YOUR RIGHTS AS A DATA SUBJECT

Under the DPA of 2012, you have the following rights as a data subject:

Be informed whether personal information pertaining to him or her shall be, are being or have been processed;

Be furnished the information indicated hereunder before the entry of his or her personal information into the processing system of the personal information controller, or at the next practical opportunity:

Description of the personal information to be entered into the system;

Purposes for which they are being or are to be processed;

Scope and method of the personal information processing;

The recipients or classes of recipients to whom they are or may be disclosed;

Methods utilized for automated access, if the same is allowed by the data subject, and the extent to which such access is authorized;

The identity and contact details of the personal information controller or its representative;

The period for which the information will be stored; and

The existence of their rights, i.e., to access, correction, as well as the right to lodge a complaint before the NPC.

If you would like to make any request in relation to your rights as a data subject, please contact our Data Protection Officer (“DPO”) with the contact details listed below. Please note that the exercise of some of your rights as a data subject is subject to review and may result in the denial of any application currently pending.

If you would at any time like to review or change the information in your account or terminate your account, you can send an email to e.malalad@thorgroup.sg and clearly indicate the desired action.

THIRD PARTY LINKS

Our site may contain links to third party websites. If you follow a link to any of these websites, please note that these websites have their own terms and privacy policies and that we do not accept any responsibility or liability for them.

SOCIAL MEDIA FEATURES

Our Mocasa Website includes Social Media Features such as the Facebook Like button. These Social Media Features may collect your IP address, which pages you are visiting on our site, and may set a cookie to enable the Feature to function properly. Social Media Features and Widgets are either hosted by a third party or hosted on our Site. Your interactions with these Features are governed by the privacy policy of the company providing it.

CHANGES TO PRIVACY POLICY

We may make changes to this Privacy Policy from time to time that are necessary for our business requirements or the law. The updated version will be indicated by an updated “Revised” date and the updated version will be effective as soon as it is accessible. If we make material changes to this Policy, we may notify you by prominently posting the updated Privacy Policy. We encourage you to visit this page from time to time to ensure you have read our most current Privacy Policy to be informed of how we are protecting your information.

DATA PROTECTION OFFICER

The Data Protection Officer (DPO) is the individual principally responsible for ensuring that Philippine Cashtrout Lending Corp. complies with all applicable laws and regulations for the protection of data privacy and security. The DPO is likewise responsible for the supervision and enforcement of this Policy. You may reach the DPO via the following contact information:

Ernelo M. Malalad, Jr.

Data Protection Officer

Philippine Cashtrout Lending Corp..

5th Floor Rockwell Business Center Tower 1, Meralco Avenue, Ortigas. Ugong, City of Pasig, Metro Manila

email address: e.malalad@thorgroup.sg

You have the right to request access to the personal information we collect from you, change that information, or delete it in some circumstances. To request to review, update, or delete your personal information, please email us at e.malalad@thorgroup.sg.

QUESTIONS

If you have any questions, concerns or complaints about this Privacy Policy, or our use of your personal information, please email us at helpdesk@mocasa.com.

YOUR ACKNOWLEDGMENT AND CONSENT

By communicating with us using the Mocasa Platform, you acknowledge that you have read and understood this Policy and agree and consent to the use, processing and/or transfer of your Personal Information by us as described in this Privacy Policy.

You agree that we may use our Personal Data and other Information for automated processing, automated decision-making, profiling, and credit scoring in connection with your application, establishment, maintenance, cancellation and/or closure of your account and your relationship with us including the provision of our Services and your use of the Mocasa Platform and our Services.

From time to time we may modify, update or amend the terms of this Privacy Policy by placing the updated Privacy Policy on the Mocasa Platform. The effective date of such modifications, updates or amendments will be noted at the start of the Policy. You should therefore review it periodically so that you are up to date on our most current policies and practices.

If we make material changes to our practices regarding the processing and/or use of your personal information, your personal information will continue to be governed by the version of the Privacy Policy to which such personal information was subject (prior to those changes), unless you have been provided notice of, and have not objected to, the changes.

By continuing to communicate with us, by continuing to use the Mocasa Platform and our Services or by your continued engagement with us following the modifications, updates or amendments to this Policy, such actions shall signify your acceptance of such modifications, updates or amendments; provided, we shall secure your express consent when so required by the Law.

By submitting the required personal information to us, you consent to such collection, disclosure and use thereof. You hereby expressly waive and release us from any and all liability, claims, causes of action or damages arising from our legitimate use of the submitted personal information.

When you activate the use, we will collect your device information (IDFV, AndroidID, operating system, device model, device manufacturer, system version, etc.) through ThinkingData for statistical analysis of your use effect in the app.

Nothing follows.