Mocasa App Privacy Policy

Updated Date: July 2025

Philippine

Cashtrout Lending

Corp.,

a

corporation organized

and

existing in the Philippines

(“Mocasa”, “we”, “us” or “our”) takes

your

privacy very seriously.

This

privacy policy

(this

“Privacy

Policy”) describes

what

information we collect

from

you,

the

purposes for which

we

collect and process

it,

how

we

use

it,

who

we

share

it

with,

how

long

we

retain

it,

and

your

rights

in

relation to it. You should

read

and

understand this Privacy

Policy

in

its

entirety.

This Privacy

Policy

applies in connection

with

your

use

of

the

Mocasa

mobile

application found

here

(the

“Mocasa

App”) and your use of our services

through the Mocasa

App

or

otherwise.

1. What personal data does Mocasa collect and process? From where does Mocasa collect your personal information?

Mocasa

collects the following

personal data (as defined

under

applicable law),

including personally

identifiable information. The collection

of

this

data

is

limited to what is adequate,

relevant, suitable,

and

strictly necessary

for

our

declared, specified,

and

legitimate purposes,

in

adherence to the principle

of

proportionality as required

by

the

Data

Privacy Act of 2012 and relevant

NPC

issuances:

-

Identification data

(e.g., first

name, surname,

date

of

birth, image, marital

status for

identity verification

and

KYC

purposes);

-

Data

provided by you

through your

responses (e.g.,

information and

documents about

your

income or employment,

your

educational attainment,

information about

your

mobile device

necessary for

assessing your

financial capacity

and

loan

eligibility);

-

Contact

details (e.g.,

address, phone

number, alternate

phone number,

email address

used

for

communication regarding

your

application, account,

and

for

legitimate debt

collection activities

strictly in accordance

with

ethical standards

and

legal limits);

-

Government-issued identification

data

and

documents (e.g.,

SSS

ID,

UMID, Passport,

Driver’s License,

PhilSys ID collected

and

processed solely

for

identity verification,

KYC,

and

fraud prevention

as

required by law);

-

Mobile

device specifications

(e.g., SIM,

IMEI, IP address,

or

other device

identifiers, type

of

device, device

operating system,

device settings,

user

account information

for

your

mobile device,

the

name

and

network information

of

your

mobile network

provider, device

specifications (such

as

screen size,

resolution, CPU

capacity, etc.))

collected to ensure

device compatibility,

security, fraud

detection, and

to

enhance user

experience;

-

Location

data

(e.g., mobile

device location

collected with

your

explicit consent

for

fraud prevention,

risk

assessment, and

to

tailor relevant

services available

in

your

region, limited

to

what

is

essential for

these purposes);

-

SMS

receiving records

(e.g. sender

number, sender

name, text

content, and

receiving time

specifically transaction-related and

OTP-related SMS,

analyzed solely

for

credit evaluation

and

to

determine appropriate

credit limits, and

verification of identity

during daily

communication or interaction

between you

and

Mocasa, as detailed

in

our

specific consent

mechanisms);

-

Transaction

data

and

financial information

(e.g., loans,

payments, loan

requests, tax

information essential

for

providing and

managing our

financial products

and

services, including

loan

disbursement and

repayment tracking);

-

Device

behavioural data

(e.g., types

and

nature of mobile

applications found

on

your

mobile device

collected to derive

aggregated and

anonymized insights

or

proportional metadata

to

enhance our

credit scoring

models, detect

fraud patterns,

and

improve the

overall security

and

functionality of the

Mocasa App.

This

data

is

not

used

to

uniquely identify

or

profile individual

users based

on

their specific

app

usage, nor

for

direct marketing

without separate,

explicit consent.

We

strictly avoid

collecting data

that

is

not

relevant or necessary

for

our

stated purposes.);

-

Telecommunications usage

data

(e.g., subscription

data, payment

details, applications

and

usage data,

telco score

used

for

credit assessment

and

fraud prevention,

where permissible

and

with

appropriate consent);

-

Mocasa

App

usage (e.g.,

traffic (volume)

data, information

about your

usage or non-usage

of

the

Mocasa App

used

to

analyze and

improve the

performance and

usability of the

application and

its

services);

-

Information

related to your

communications with

Mocasa (e.g.,

your

communications with

Mocasa via

in-app chat,

email, telephone

or

other channels, used

for

customer service,

dispute resolution,

and

quality assurance);

-

Information

provided by you

in

relation to participation

in

special offers

and

promotional activities

conducted by Mocasa

(e.g., promo

codes, games,

contests, discounts,

and

participation in by-invitation-only groups

used

solely for

the

administration of such

activities);

-

Certain

third party

data

(e.g., information

provided to or from

credit reference

agencies or bureaus,

external collections

agencies, mobile

network providers, obtained

with

your

consent or where

a

legitimate interest

or

legal obligation

applies, for

creditworthiness assessment,

fraud prevention,

and

debt

collection).

Mocasa

collects your personal

data

from:

-

You,

when

you

download the Mocasa

App and/or

indicate that

you

want

to

apply for

credit, providing

data

directly through

the

application process

and

your

interactions;

-

Your

other interactions

with

us,

including Information

you

may

voluntarily share

with

our

customer support

team

or

other Mocasa

employees or agents;

-

Your

mobile device

(through the

device permissions

you

explicitly grant,

as

more

fully described below);

-

Credit

reference agencies

(who

may

check your

personal data

against other

databases – public

and

private – to which

they

have

access) or fraud

prevention agencies

for

credit assessment

and

fraud detection

purposes.;

-

Third

parties and

other publicly

available sources,

with

your

explicit consent,

when

it

is

necessary for

the

performance of our

contract with

you

or

(e.g. we may

receive Information

from

other disbursement

channel vendors

or

other business

partners such

as

telecommunications companies

and

credit scoring

service providers

that

may

assist us in providing

services to you)

when

required or permitted

by

applicable laws

and

regulations;

-

Third

parties who

communicate with

us

through the

contact information

that

you

provided to us (e.g.,

character references

you

explicitly provided).

Collection

and

processing of your personal

data

by

Mocasa

is

necessary for the declared,

specified, and legitimate

purposes of providing

Mocasa’s products

and

services, assessing

your

eligibility, mitigating

risks,

and

to

comply

with

applicable legal

and

regulatory requirements

(such

as

KYC,

AML,

and

consumer protection

laws)

to

which

you

and/or

Mocasa

is

subject. Apart

from

such

cases

where

processing is necessary

due

to

contractual obligations,

legal

compliance, or our legitimate

interests which

do

not

override your fundamental

rights

and

freedoms, we do not collect

Information without

your

specific, informed prior consent.

2. What are the purposes for which your personal data is processed? How does Mocasa use your personal information?

Mocasa

processes your personal

data

only

for

declared, specific,

and

legitimate purposes,

necessary for the provision

of

our

products and services,

and

in

compliance with all applicable

laws

and

regulations. We ensure

that

the

processing of your data is proportional to these

purposes and not excessive.

Your

data

is

processed for the following

purposes:

-

To

assess your

eligibility to use

our

products or services: this

includes, but

is

not

limited to,

comprehensive credit

scoring, assessing

your

creditworthiness, determining

your

financial capacity

to

afford requested

products or services,

and

evaluating your

eligibility for

additional benefits

of

an

existing product.

This

is

essential to ensure

responsible lending;

-

To

service and

manage your

account with

Mocasa (including,

but

not

limited to processing

the

disbursement of your

funds, managing

your

loan

details, and

facilitating the

collection of your

outstanding balance

in

accordance with

your

loan

agreement and

applicable laws;

-

To

verify your

identity and/or

other information

you

provided to us;

-

To

personalize credit

assessment, risk

analysis, and

implement control

measures: This

allows us to tailor

financial products

to

your

specific profile,

manage potential

risks effectively,

and

ensure the

stability and

security of our

lending operations;

-

To

detect, combat, and

prevent fraud,

attempted fraud,

money laundering, and/or

other illegal

uses

of

our

services: we employ

robust measures

to

protect our

users and

our

platform from

illicit activities,

safeguarding the

financial ecosystem.;

-

To

analyze customer

behavior: we analyze

aggregated and

anonymized customer

behavior patterns,

including insights

derived from

device behavioral

data

(e.g., types

and

nature of mobile

applications found

on

your

device), solely

for

the

purpose of enhancing

our

credit scoring

models, improving

fraud detection

mechanisms, and

optimizing the

overall user

experience and

security of the

Mocasa App. This

analysis is done

without identifying

or

profiling individual

users based

on

their specific

app

usage, and

strictly adheres

to

proportionality.;

-

To

administer our

systems, maintain

service quality, and

compile general

usage statistics: this

ensures the

reliable operation

of

the

Mocasa App

and

allows us to monitor

performance;

-

To

analyze and

continually improve

our

services and

product offerings:

your

usage data

helps us understand

how

our

services are

used, allowing

us

to

enhance features,

improve efficiency,

and

develop new

products that

better serve

your

needs;

-

To

troubleshoot any

technical problems

you

or

other customers

encounter with

Mocasas services: this

ensures seamless

operation and

prompt resolution

of

user

issues;

-

To

comply with

applicable laws,

regulations, and

rules: this

includes, but

is

not

limited to,

fulfilling obligations

related to "know-your-customer" (KYC)

requirements, customer

verification, transaction

monitoring, anti-money

laundering (AML),

and

reporting obligations

to

regulatory bodies;

-

To

send

you

marketing or advertising

notices or other

promotional offers: to the

extent you

have

not

objected to the

use

of

your

personal data

for

direct marketing

purposes after

proper notification, we may

send

you

relevant marketing

or

advertising notices

or

other promotional

offers about

our

products and

services. You

always have

the

right to opt-out

of

such

communications;

-

To

provide service

updates and

important notifications:

this

ensures you

are

informed about

changes to our

terms, services,

or

any

critical security

alerts;

-

To

provide staff

training: where

necessary and

with

appropriate safeguards,

we

may

monitor or record

customer interactions

to

ensure quality

of

service and

for

staff development;

-

To

interface with

credit reference

or

fraud prevention

agencies, necessary

for

assessing your

creditworthiness, reporting

credit information,

and

preventing fraudulent

activities;

-

To

provide customer

service or support

and

to

resolve disputes

and

complaints, this

is

to

address your

inquiries, concerns,

and

resolve any

issues effectively;

-

To

contact you

by

telephone using

autodialed or prerecorded

message calls

or

text

(SMS) messages

(if

applicable): as authorized

for

the

legitimate purposes

described in this

Privacy Policy, including

for

account management,

loan

reminders, and

important service

notifications.

We process

your

personal data for the purposes

set

out

above

on

the

following lawful

grounds, in compliance

with

applicable data privacy

laws:

-

To

carry out

our

obligations to you: this

includes fulfilling

our

responsibilities as a result

of

any

contracts or agreements

entered into

between you

and

us

(i.e., where

processing is necessary

for

the

adequate performance

of

our

contract with

you

and/or to take

steps requested

by

you

prior to entering

into

a

contract with

you, such

as

a

loan

application);

-

To

carry out

our

legal obligations: wherein

processing is necessary

for

compliance with

a

legal obligation

to

which Mocasa

is

subject under

applicable law

(e.g., KYC,

AML

laws, regulatory

reporting);

-

In

connection with

our

legitimate interest: where

processing is necessary

for

the

purposes of the

legitimate interests

pursued by Mocasa

or

by

a

third party,

except where

such

interests are

overridden by your

fundamental rights

and

freedoms. Our

legitimate interests

include (1)

responsibly providing

you

with

credit and/or

other financial

or

technological products

or

services, (2)

operating and

expanding our

business effectively, (3)

marketing our

relevant products

and

services to you

and

others (4) administering

our

systems and

(5)

keeping our

records accurate

and

up

to

date;

-

With

your

prior consent: where

we

have

obtained your

specific, informed,

and

explicit consent

for

a

particular processing

activity, especially

for

activities not

covered by a contractual

obligation, legal

compliance, or legitimate

interest. You

have

the

right to withdraw

your

consent at any

time, subject

to

legal or contractual

restrictions.

3. Who do we share your personal data with?

Mocasa

is

committed to safeguarding

your

personal data.

We

will

not

disclose any information

containing your personal

data

(as

defined under

applicable law) to any third

parties unless

it

is

necessary and/or

appropriate for our declared,

specified, and legitimate

purposes, to provide

Mocasa's products

or

services (provided,

that,

we

may

share

limited personal

data

(as

defined under

applicable law) with select

partners for research

and

development). We adhere

to

the

principles of data minimization

and

purpose limitation

when

sharing your data.

Whenever practically

feasible, and where

the

purpose can still

be

achieved Mocasa

will

only

share

your

personal data with third

parties in an anonymized

or

de-identified format.

You understand

and

agree

that

we

may,

as

necessary and/or

appropriate for the purposes

provided above,

transfer and disclose

your

personal data to the following

categories of recipients:

-

Employees,

subcontractors, agents,

service providers,

or

associates of the

Philippine Cashtrout

Lending Corp.

(including directors

and

officers), who

require access

to

perform their

functions and

responsibilities in delivering

our

services and

operating our

business;

-

bank

partners;intermediary, correspondent

and

agent banks,

non-banks, quasi-banks

or

other financial

institutions, clearing

houses, clearing

or

settlement systems,

market counterparties,

upstream withholding

agents, licensed

electronic or mobile

wallet providers,

remittance and

transfer companies,

credit reference

agencies or credit

bureaus, such as TransUnion, SKYPAY and its affiliate SKYBRIDGE PAYMENT INC., for

purposes of facilitating

transactions, assessing

creditworthiness, providing

customized services upon your consent and need, fraud

prevention, and

complying with

financial regulations;

-

Service

providers with

contractual or fiduciary

relationships with

Mocasa (e.g.,

to

facilitate transaction

processing, fraud

prevention, cloud

data

storage or data

transfer), who

are

essential for

the

technical and

operational functioning

of

our

services.;

-

telecommunication companies

(e.g., Globe,

TM,

GOMO, Smart,

Talk&Text, PLDT,

Sun

Cellular), where

necessary for

services like

OTP

delivery, telecommunications usage

data

for

credit assessment

(with your

consent), or fraud

prevention;

-

external

collection agencies

(to

assist in the

collection of any

unpaid obligations

to

us)

we

share only

the

necessary data

required for

collection efforts.

Mocasa strictly prohibits external collection agencies from using your personal data, including your photo or any sensitive information, to harass, embarrass, or engage in any unfair, unethical, or illegal collection practices. All

our

agreements with

collection agencies

mandate strict

adherence to the

Data

Privacy Act

of

2012, its

Implementing Rules

and

Regulations, and

other relevant

consumer protection

laws.;

-

external

counsel, external

auditors, and

consultants, when

necessary to resolve

disputes or complaints, conduct

audits, or ensure

legal and

regulatory compliance.;

-

a

party in connection

with

any

merger, acquisition, or sale

of

all

or

substantially all

of

the

assets of Mocasa

and/or any

company within

the

Philippine Cashtrout

Lending Corp.;

-

a

party in

connection with

any assignment

of

credit or

the creation

of

a

security interest

involving outstanding

balances owned

to

Mocasa,

in

compliance with

applicable laws;

-

to

other public

or

private third

parties to the

extent that:

(1) we have a duty to disclose

or

share

your

personal data in order

to

comply

with

any

legal

obligation (e.g.,

the

Credit

Information Corporation,

the

Bureau

of

Internal Revenue, Bangko

Sentral ng Pilipinas, Securities

and

Exchange Commission),

(2) it is necessary

or

appropriate to enforce

or

apply

any

agreement with you including

our

Terms

and

Conditions, and/or

(3) it is necessary

or

appropriate to protect

the

rights, property,

or

safety

of

Mocasa, the Philippine

Cashtrout Lending

Corp., our employees,

and/or

our

customers, including

for

preventing fraud

or

addressing security

vulnerabilities.

The above

parties may also process

or

disclose your personal

data

for

the

purposes set forth

above,

so

long

as

such

processing or disclosure

is

in

compliance with this Privacy

Policy, applicable

laws,

and

subject to appropriate

data

processing agreements

and

confidentiality clauses.

Further, While

we

strives to select reputable and reliable partners during our recommendation or referral of third-party products, services

and ensure our own practices align with data protection

standards, it is important to exercise caution that these third-party

products and services are operated under their own

distinct privacy statements and practices, which are beyond our control. To further protect yourself, we strongly recommend reviewing the privacy policies

of these third-parties before providing any personal information to facilitate their product or services. When you navigate away from our Site (which can be determined by

checking the URL in your browser’s address bar), any information you consent to provide to these external sites is

subject to the Privacy Policy of the respective website operator. We cannot provide any representation or warranty

regarding how your information is stored or used on financial partners and third-party servers, and we are unable

to take any responsibility in any form for any violation of your information conducted by such financial partners

and third-party servers.

Further,

Mocasa

may

also

share

your

personal data with law enforcement

or

other

government agencies

(e.g.,

National Privacy

Commission, National

Bureau

of

Investigation, Philippine

National Police)

in

connection with a formal

request, subpoena,

court

order,

or

similar legal

procedure, or when we believe

in

good

faith

that

disclosure is necessary

to

comply

with

the

law,

prevent physical

harm

or

financial loss,

to

report

suspected illegal

activity, or to investigate

violations of our agreements

with

you.

4. For how long will we retain your personal data?

Your personal

data

will

be

stored

or

retained by Mocasa

only

for

the

period

necessary

to

fulfill the declared,

specified, and legitimate

purposes for which

it

was

collected, as outlined

in this Privacy

Policy. This adherence

to

purpose limitation

and

data

minimization ensures

your

data

is

not

kept

longer

than

required.

We are required

to

retain

certain personal

data

for

a

minimum period

of

at

least

five

(5)

years

in

compliance with anti-money

laundering and terrorism

financing prevention

regulations, as well as other

specific legal

and

regulatory obligations

to

which

Mocasa

is

subject, notwithstanding

deletion requests.

We may also retain

your

personal data:

(i) for as long as necessary

to

comply

with

any

other

applicable legal

or

regulatory obligation;

(ii) whenever

such

retention is expressly

authorized by law; and

(iii)

for

the

establishment, exercise,

or

defense of legal

claims

or

defenses.

Information

that

is

no

longer

needed

for

the

purpose(s) for which

it

was

collected shall

be

deleted or anonymized, except

as

necessary to comply

with

legal

obligations.

5. Where do we process, store or transfer your personal data?

We are committed

to ensuring

that

adequate safeguards

are

in

place

in

accordance with applicable

law

and/or

the

Philippines data protection

requirements. The safeguards

we

will

use

will

depend

on

the

circumstances and the party

to

whom

we

transfer your personal

data.

Your

personal data may be processed

by

any

of

the

parties described

above, who are also bound

by

appropriate data protection

commitments. Mocasa

employs all reasonable

and

appropriate

organizational, technical,

and

physical security

measures to protect

your

personal data against

accidental or unlawful

destruction, alteration,

unauthorized disclosure,

access, misuse,

or

any

other

unlawful processing,

as

required by applicable

law

and

industry benchmark

practices.

6. Automated decisions and profiling

To provide

you

with

rapid,

efficient, and tailored

services, we may make certain

decisions in relation

to

our

provision of products

and

services to you by using

automated decision-making

(ADM)

processes, which

may

involve profiling,

in

relation to our provision

of

products and services.

These

processes operate

with

limited to no human

involvement and are based

on

the

personal data collected

about

you.

When you apply

for

credit

or

seek

eligibility for our products

and

services, well use automated

processing to make decisions

regarding your application,

including whether

to

lend

to

you

and/or

make

other

decisions about

your

eligibility for our products

and

services, based

on

the

personal data collected.

This

automated processing

enables us to provide

rapid,

responsive, and tailored

credit

services to customers

who

may

not

have

traditional credit

histories, prior

bank

or

other

financial data, or income

from

formal

sources.

Our credit

and

underwriting models

utilize data science

and

machine-learning technology

to

process your personal

data

and

assess

your

creditworthiness. The associated

processing of your personal

data

is

automated and little

to

no

human

intervention is involved.

Using

such

automated processes

to

assess

your

creditworthiness means

we

may

automatically decide

that

you

may

be

ineligible for our services

or

ineligible for credit

of

a

particular amount

or

tenure. Our credit

and

underwriting models

are

regularly tested

and

validated to ensure

they

remain

fair,

accurate, unbiased, and compliant

with

all

applicable laws and regulations.

Mocasa

also

utilizes automated

processes to detect,

combat

and

prevent fraud, attempted

fraud,

money

laundering, and other

illegal uses of our services. Our fraud

models

may

automatically identify

patterns or behaviors

that

indicate that a certain

individual poses

a

fraud

or

money

laundering risk (e.g.,

if

our

processing reveals

information or behavior

consistent with money

laundering or known

fraudulent activity,

if

the

activity is inconsistent

with

prior

activity on our platform

or

if

an

individual appears

to

be

hiding

their

true

identity). If our fraud

models

determine that processing

a

transaction or approving

a

certain individual

creates a risk of fraud,

that

individual’s access

may

be

suspended or refused.

7. Your rights as a data subject

As a data subject

under

the

Data

Privacy Act of 2012 (DPA)

and

its

Implementing Rules

and

Regulations (IRR),

you

are

afforded specific

rights

concerning your personal

data.

Mocasa

is

committed to upholding

these

rights. You may contact

us

to

exercise your rights

as

a

data

subject at support.user@mocasa.com. Please

note

that

there

may

be

occasions when you wish to exercise

your

rights

and

we

are

unable

to

agree

to

your

request (e.g.,

because we have compelling

legitimate ground

for

using

or

processing your personal

data

or

because we we need to retain

your

personal data to comply

with

a

legal

obligation).

We must provide

you

with

certain information

related to how we collect

your

personal data,

details on how we collect,

use, and process

your

personal data (and our legal

basis

for

doing

so),

who

we

share

your

personal data with,

where

we

obtained your personal

data, and your rights

as

a

data

subject. This information

is

provided within

the

Mocasa

App

and

in

this

Privacy Policy

in

clear

language.

You may ask for a copy of the personal

data

(as

defined under

applicable law) we hold concerning

you

(and

your

Information related

to

such

personal data),

as

well

as

information on how such personal

data

has

been

processed and obtained, the names

and

addresses of the recipients

to

whom

your

personal data has been disclosed

or

transferred, unless

providing some or all of it would

adversely affect

the

rights

and

freedoms of others

or

applicable law (such

as

trade

secret

protection or a court

order)

specifically requires

that

we

do

not

comply

with

your

request for certain

highly

sensitive or proprietary

information. The right

to

access

does

not

apply

to

analyses algorithms or

methodologies made by the Mocasa

with

respect to your personal

data,

which are proprietary know-hows and trade secrets belonging to Mocasa.

You may ask us to correct

any

personal data which

you

believe to be inaccurate.

We

will

promptly update

any

such

personal data.

In

connection with your request,

you

may

be

required to provide

supporting evidence

or

other

documentation so that we may verify

the

accuracy of the request.

-

Right to erasure or blocking

You may make requests to us

regarding the suspension,

withdrawal, blocking,

removal, or destruction

of

your

personal data from our systems

under

certain circumstances.

You

may

ask

us

to

erase

your

personal data in the following

instances:

-

If

you

believe it’s no longer

necessary for

us

to

retain such

personal data

(such as a legal

obligation or contractual

necessity) for

us

to

continue processing

it;

-

If

you

do

not

believe we have

legitimate ground

for

processing it;

-

If

you

think we are

using such

personal data

for

unauthorized purposes;

-

If

you

think applicable

law

or

a

court order

requires that

we

do

so;

or

-

If

you

believe the

personal data

is

incomplete, false,

or

unlawfully obtained;

-

Right to restrict or object to processing

Where

the

processing of your personal

data

is

based

on

your

consent or our legitimate

interest, you may ask us to stop using

your

personal data (as defined

under

applicable law) when:

-

You think

such

personal data

is

inaccurate, incomplete,

or

unlawfully obtained;

-

you

think your

personal data

is

used

for

unauthorized purposes;

-

if

you

don’t want

us

to

destroy such

personal data

because you

need

it

for

legal proceedings, for

the

fulfillment of contractual

or

legal obligation;

-

if

you’ve informed

us

that

we

don’t have

a

legitimate reason

for

using it and

we’re considering

your

request;

-

Right to data portability

If we’re using

your

personal data on the basis

of

your

consent or because

we

need

it

to

carry

out

our

contractual obligations

to

you,

you

can

ask

us

to

give

you

your

personal data (as defined

under

applicable law) in a structured,

commonly-used and machine-readable

format

or

have

it

transmitted to another

data

controller. The right

to

data

portability is limited

to

data

that

you

provided actively

and

knowingly, or that you provided

by

virtue

of

the

use

of

our

services.

You have the right

to

file

a

complaint with the relevant

government agencies

for

any

violation of your rights

as

a

data

subject. Please

note

that

there

may

be

occasions when you wish to exercise

your

rights

and

we’re unable

to

agree

to

your

request (e.g.,

because we have compelling

legitimate grounds

for

using

or

processing your information

or

because we need to retain

your

information to comply

with

a

legal

obligation).

Mocasa

is

committed to transparent

and

responsible management

of

the

permissions you grant

us.

We

will

only

access

your

device

permissions (e.g.,

SMS,

camera) for the specific,

legitimate purposes

outlined in this Privacy

Policy.

Once the specific

purpose for which

an

application permission

was

granted has been fulfilled,

and

where

there

are

no

other

applicable lawful

criteria requiring

continuous access

to

that

particular permission

for

the

provision of our services

or

compliance with legal

obligations, the Mocasa

App

will:

prompt

you

through appropriate

in-app

notices (e.g.,

just-in-time, pop-up

notifications) to inform

you

that

access

to

the

relevant application

permission may already

be

revoked, and guide

you

on

how

to

turn

it

off

or

disallow it through

your

device

settings.

Where

technically feasible

and

aligned with device

operating system

capabilities, the Mocasa

App

will

automatically turn off such permissions

by

default after

the

purpose is achieved,

provided it does not impair

essential, ongoing

services for which

explicit, continued

consent or legal

basis

exists.

8. Advertising and Marketing

If you no longer

wish

to

receive advertising,

marketing, or promotional

messaging, please

contact us at support.user@mocasa.com and we will remove

you

from

such

communication lists.

9. Consequences of not providing us with your personal data

You are not required

to

provide us with your Information

or

any

associated personal

data

(as

defined under

applicable law) and you may withdraw

your

consent from the use or processing

of

such

Information or personal

data

at

any

time. However,

if

you

do

so,

we

will

be

unable

to

provide our current

or

future

products and services

to

you, and we reserve

the

right

to

terminate our relationship

with

you,

as

permitted under

applicable law, discontinue

our

relationship with you as we would

be

unable

to

fulfill our contractual

obligations.

Further,

to

the

extent

we

have

a

legitimate interest

in

retaining your Information

and/or

associated personal

data

(as

defined under

applicable law),

we

may

do

so.

For

example, if you have requested

that

we

erase

your

Information or associated

personal data (as defined

under

applicable law),

but

you

have

an

outstanding balance

with

Mocasa, we may retain

your

Information or associated

personal data (as defined

under

applicable law),

in

order

to

continue collection

efforts. We are also required

to

retain

your

personal data for a period

of

at

least

five

(5)

years

in

compliance with anti-money

laundering and terrorism

financing prevention

regulations, notwithstanding

requests for deletion.

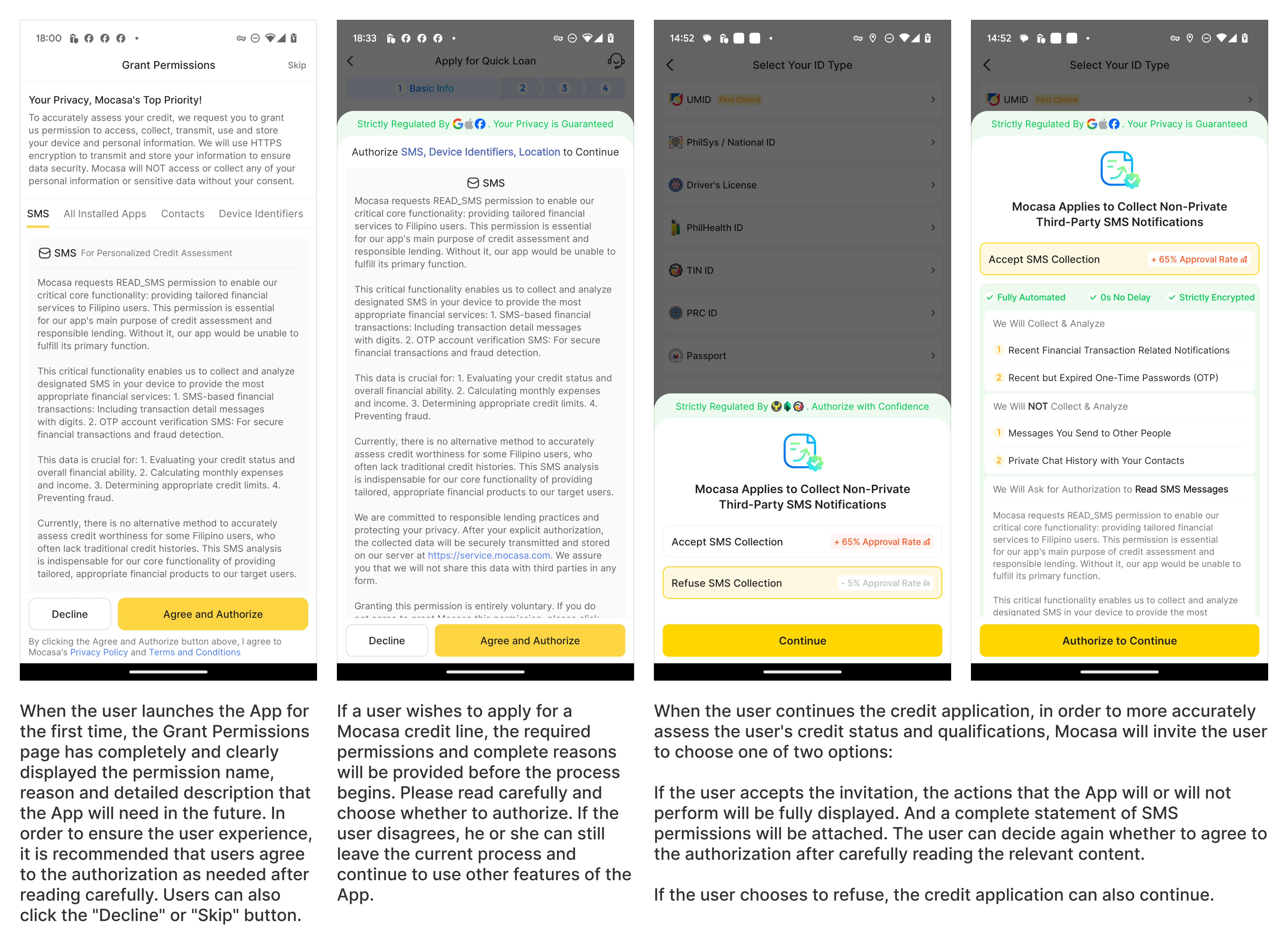

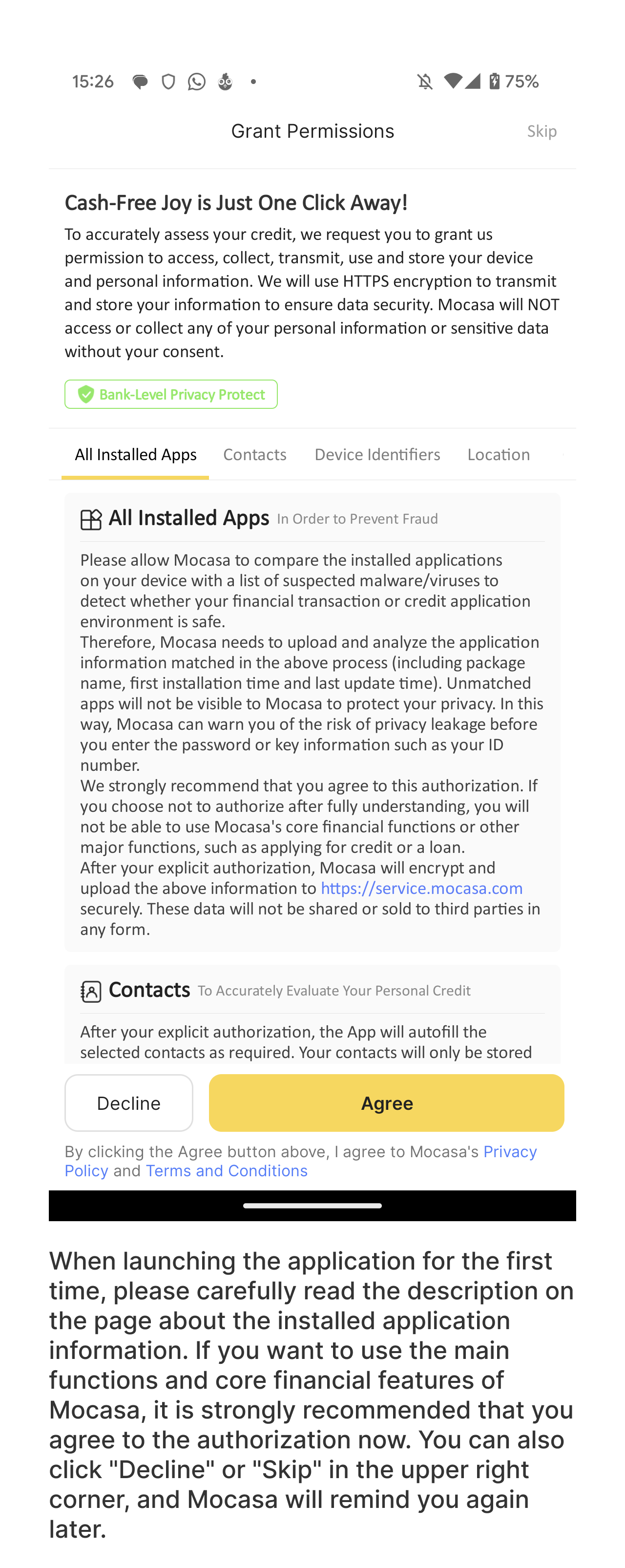

10. Consent and Authorization

By downloading

the

Mocasa

App

and

clicking “Agree” on the permissions

overview screen,

you:

-

Confirm

that

you

have

read, understood,

and

accept the

terms of this

Privacy Policy,

which comprehensively

outlines how

your

personal data

is

collected, used,

shared, and

otherwise processed;

-

Acknowledge

and

agree to Mocasa's

access to necessary

device permissions,

as

more

fully described

above and

detailed within

the

permissions overview

screen. You

understand that

access to certain

device data

is

essential for

the

functionality, security,

and

credit assessment

features of the

Mocasa App;

-

Grant

your

explicit consent

to

Mocasa to collect,

use,

share, or otherwise

process your

personal data,

which may

include personally

identifiable information,

personal information,

sensitive personal

information (in

each

case, as defined

under applicable

law), for

the

purposes where

consent is the

lawful basis

as

outlined in this

Privacy Policy;

-

certify

that

all

personal data

you

have

provided and

will

provide to Mocasa

is

true, accurate,

and

correct to the

best

of

your

knowledge and

belief;

-

authorize

Mocasa to verify/investigate the

accuracy of your

personal data

through various

means, as necessary

for

the

provision of our

services, credit

assessment, and

fraud prevention.;

-

acknowledge

that

Mocasa may

be

required to disclose

your

personal data

to

regulatory and

governmental bodies

such

as

the

Securities and

Exchange Commission,

Bangko Sentral

ng

Pilipinas, Anti-Money

Laundering Council,

Bureau of Internal

Revenue, Credit

Information Corporation,

credit bureaus

and/or any

other governmental

body, in compliance

with

its

legal obligations

and

in

accordance with

the

principle of proportionality.

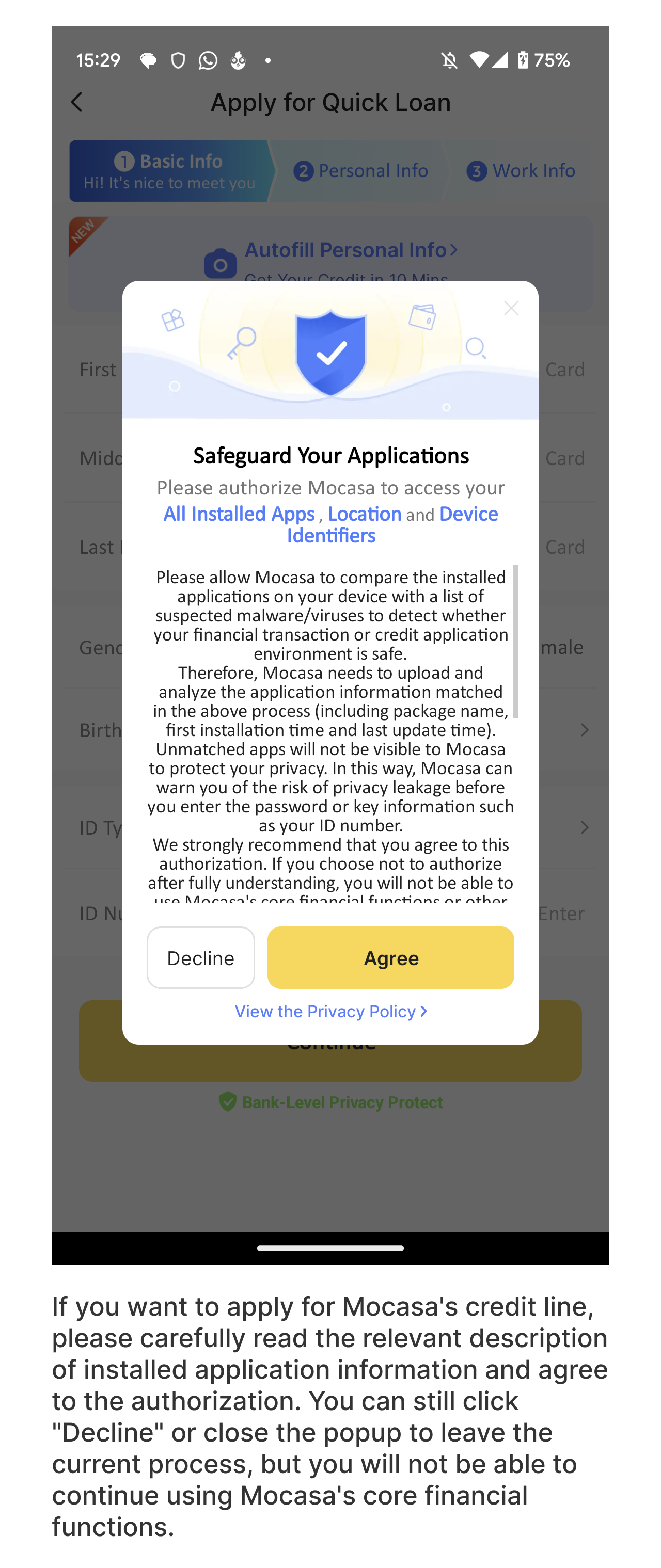

11. What device permissions does the Mocasa app access?

Depending

on

your

Device

Operating System

and

the

version of the Mocasa

app

installed on your device,

the

following device

permissions may be accessed

by

the

Mocasa

App.

We

encourage you to keep your Mocasa

App

updated to make sure you can experience

the

latest

and

most

secure

features.

Below

are

the

device

permissions Mocasa

may

access, along

with

their

purposes:

-

SMS

- After

your

explicit authorization,

we

will

collect, upload

and

analyze the

specified SMS

messages (including

sender number,

sender name,

text

content, and

receiving time)

from

your

device. This

data

is

to

be

used

to

assess your

credit status

to

provide you

the

most

appropriate financial

services. This

information can

be

used

for

risk

analysis and

control, to assess

the

user's overall

financial ability

and

determine the

specific credit

limit. The

above data

will

be

transmitted and

stored on the

https://service.mocasa.com server.

If

you

do

not

agree to grant

Mocasa this

permission, click

the

"Do

Not

Allow" button

when

the

system asks

for

it. Even

if

the

user

agrees at the

moment, the

above authorization

can

be

revoked at any

time

through the

system settings.

-

Calendar

-

Mocasa may

request read

and

write calendar

permissions to specifically

remind you

of

repayment due

dates on your

bills. We will

only

read, add

and

modify calendar

events related

to

Mocasa. But

other events

you

have

set

in

your

device's calendar

will

never be read

or

modified;

-

Camera

-

Mocasa will

ask

you

to

upload a photo

of

your

ID,

proof of income,

or

a

selfie for

the

purpose of identification, to facilitate

identity verification

processes. You

can

choose to take

photos on-site

(only need

Camera permission)

or

access media

library or files

to

pick

a

photo (only

need

Photo permission);

-

Read

your

contacts – After your

explicit and

separate authorization,

the

app

will

auto-fill the

selected contacts

as

needed. Your

contact information

will

only

be

stored and

used

for

credit assessment

and

emergency contact

purposes. Only

the

contacts you

select and

explicitly allow

will

be

collected or used;

Meanwhile, please keep in mind that it is YOUR duty to acquire prior consent from your contact for our

connection with such contact, by providing us with your contacts, we assume you have acquired such

consent

-

Location

–

This

helps our

fraud models

verify your

identity and

detect suspicious

activities. Mocasa

also

uses

this

information in its

credit and

underwriting models

to

determine whether

you

are

eligible for

Mocasa’s services.

We

also

use

location data

for

research purposes;

-

Read

phone status

and

identity – We will

collect and

use

your

device ID (advertising

ID,

BSSID, IMEl, Android

ID)

to

ensure the

security of your

transactions and

payments. Granting

this

permission will

help

us

check if you

are

performing sensitive

actions on commonly

used

devices. This

will

effectively reduce

the

risk

of

your

account being

compromised or unauthorized

access.

Third-party

SDKs

collect some of our non-sensitive

device

information (for example:

IDFV,

Android ID, system

version, device

manufacturer, brand

and

model,

etc.)

for

statistical and analytical

purposes to optimize

our

experience on Mocasa.

We

only

allow

third-party SDKs to collect

non-sensitive data with your explicit

consent.

12. General

If you have questions

about

this

Privacy Policy

or

about

your

rights

as

a

Data

Subject, you can contact

our

Data

Protection Officer

at:

Roson, Trisha

Cassandra C.- Data Protection

Officer - Philippine

Cashtrout Lending

Corp..

4/F King's Court 1 BLDG., 2129 Chino Roces AVE., Pio Del Pilar, Makati,

Makati City, Metro Manila

email

address: compliance@mocasa.com

To improve

and

continue our services

to

you

and

to

comply

with

data

privacy regulations

that

may

be

issued

from

time

to

time,

this

Privacy Policy

may

be

updated. You can check

the

latest

version by visiting

www.mocasa.com and clicking

"Privacy Policy"

at

the

bottom.

13. Others

When you activate

the

use,

we

will

collect your device

information (IDFV,

AndroidID, operating

system, device

model,

device

manufacturer, system

version, etc.)

through ThinkingData

for

statistical analysis

of

your

use

effect

in

the

app.

Additionally,

your personal

data

may

be

collected, used,

processed, stored,

accessed, updated,

shared, transferred

or

disclosed to the credit

insights service

provider/s using

the

Subscriber data obtained

from

Mobile

Network Operators,

such

as

but

not

limited to, Globe

Telecom, Inc.,

for

the

purpose of “telco

score”

using

telecommunications usage

data.

The credit

scoring (telco

score)

and

analytics between

the

Bank

and

credit

insights service

providers are conducted

for

the

purpose of credit

evaluation related

to

your credit application

and

maintenance thereof.

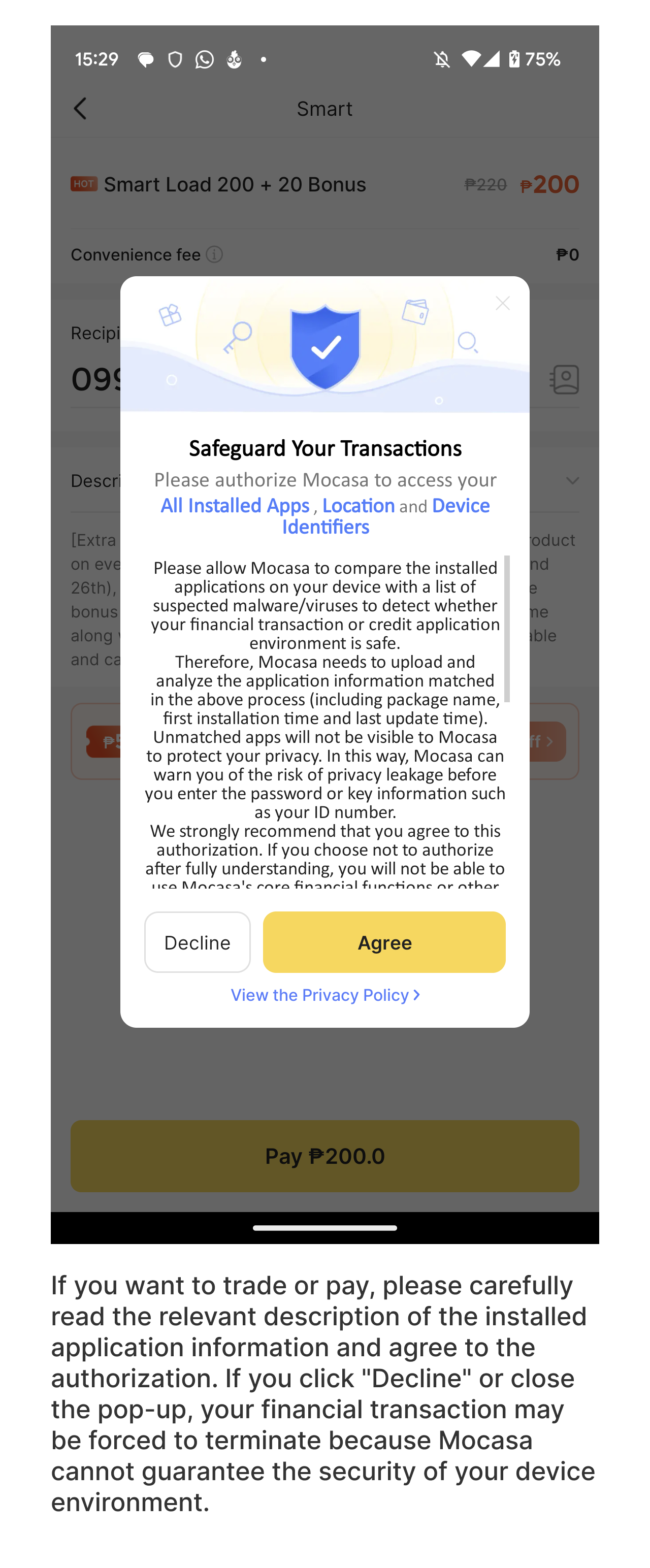

Statement of Applying for Installed Application Permission

Please

allow

Mocasa

to

compare the installed

applications on your device

with

a

list

of

suspected malware/viruses

to

detect

whether your financial

transaction or credit

application environment

is

safe.

Therefore,

Mocasa

needs

to

upload

and

analyze the NON-SENSITIVE

application identifiers

matched in the above

process to protect

Mocasa

from

any

cyber

security risk.

Mocasa

does

not

have

access

to

any

of

your

private content

in

other

applications. Unmatched

apps

will

not

be

visible to Mocasa

to

protect your privacy.

In

this

way,

Mocasa

can

warn

you

of

the

risk

of

privacy leakage

before

you

enter

the

password or key information

such

as

your

ID

number.

We strongly

recommend that you agree

to

this

authorization to ensure

the

security of your financial

transactions and enable

access

to

our

full

range

of

services. If you choose

not

to

authorize this permission

after

fully

understanding its purpose

and

implications, you will not be able to use Mocasa's

core

financial functions

or

other

major

functions, such as applying

for

credit

or

a

loan, as this information

is

critical for our risk assessment,

fraud

prevention, and the secure

provision of our services.

After

your

explicit authorization,

Mocasa

will

encrypt and upload

the

above

information to https://service.mocasa.com securely.

These

data

will

not

be

shared

or

sold

to

third

parties in any form, as these

will

only

be

processed solely

for

the

stated

purposes and will not be shared for purposes

unrelated to the security

and

credit

assessment for which

your

consent was obtained.

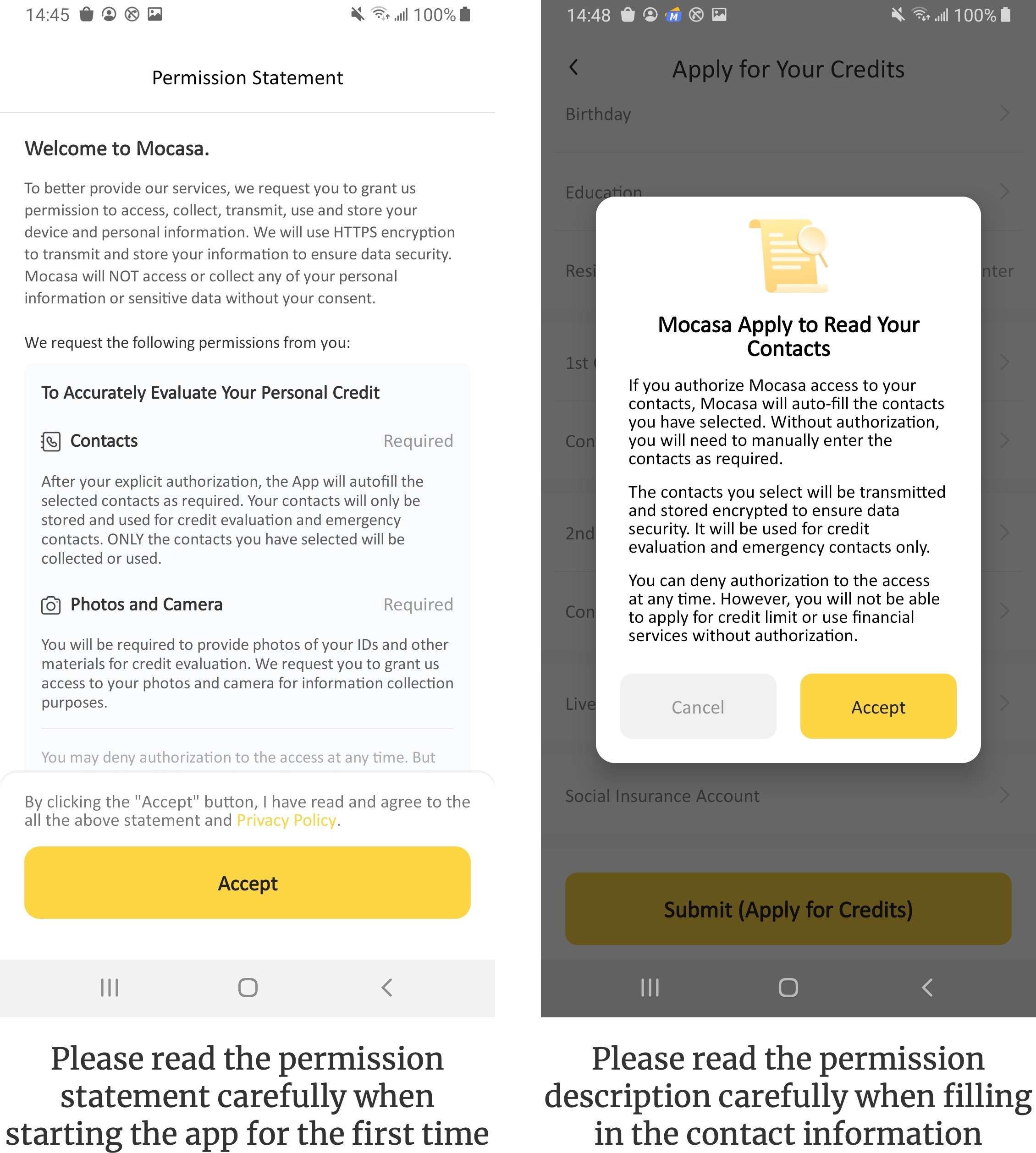

Statement of Applying for Contact Permission

To accurately

evaluate your personal

credit

and identifying and contacting the character references or guarantors

for

your

loan

application, we request

you

to

grant

us

permission to access,

collect, transmit,

use

and

store

your

contacts information.

We

will

use

HTTPS

encryption to transmit

and

store

your

information to ensure

data

security.

After

your

explicit and separate

authorization, the Mocasa

App

will

autofill the selected

contacts as required.

Your

contacts will only be stored

and

used

for

credit

evaluation and identifying and

contacting the character references or guarantors. Mocasa

does

NOT

have

access

to

all

of

your

contacts. You only need to select

contacts for the purposes

of

“credit evaluation

and

guarantors”.

Mocasa

will

NOT

access

or

collect any of your personal

information or sensitive

data

from

your

contacts without

your

direct

selection and consent.

Your

contacts will NOT be shared

or

sent

to

third

parties under

any

circumstances except

as

otherwise explicitly

consented to by you within

this

Privacy Policy

(e.g.,

for

data

sharing with financial

partners or for specific

outsourced collection

efforts where

relevant and separately

authorized).

You may deny authorization

to

the

access

at

any

time.

However, please

be

aware

that

granting this permission

and

providing emergency

contacts is often

essential for verifying

your

creditworthiness and for account

security. Without

such

authorization, you will not be able to use Mocasa

financial services,

such

as

applying for a credit

limit

or

making

payments without

authorization.

Mocasa

will

attempt to obtain

the

contact's information

and

upload

it

to

Mocasa

server

only

after

you

have

granted authorization.

If

you

wish

to

revoke

historical authorizations

and

erase

all

your

device

or

personal information,

please

contact support.user@mocasa.com. We will process

our

application within

five

(5) working

days.